Every PAYE job comes with a tax code, so if you've got more than one job, you're juggling more than one code. Each code lists some important information about how your money's taxed. For instance, it'll determine whether your Personal Allowance applies or whether you start paying tax from the very first penny you make instead.

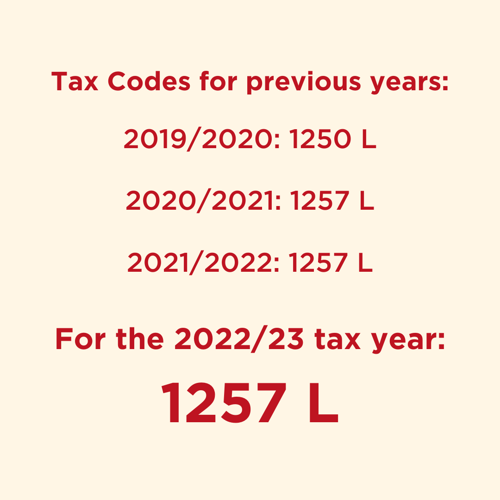

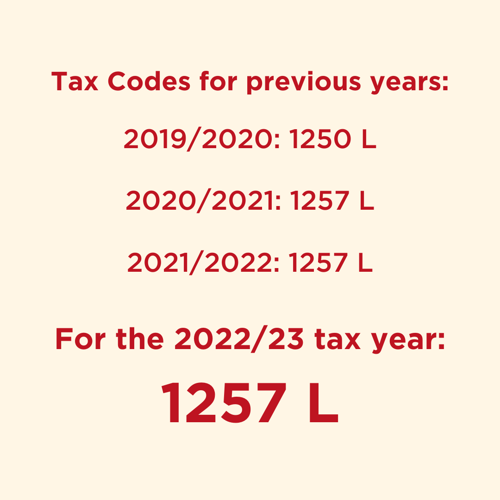

The most common tax code for the 2022/2023 tax year is 1257L. All this code means is that you've got a Personal Allowance of £12,500 a year, and won't start paying tax on anything you earn below that. The letter at the end in this case just confirms that no special circumstances apply for this job. When you've got more than one job, a few things can go wrong with your tax codes. For one thing, if your Personal Allowance gets applied to the wrong job, you can miss out badly. Generally, you'll want it applied to the job that pays you the most – since you won't get the full benefit of it if it's applied to one that brings in less than the Personal Allowance threshold (£12,500 for 2022/23).

Okay, but what if both of your jobs pay less than the Personal Allowance you're entitled to? Well, in that case you need to get things sorted out fast before they cost you money. Let's imagine your main job in 2022/23 pays you £12,000 and your side-gig pays £8,000. Applying your Personal Allowance to the main one means you're losing the benefit of £500 of it. If things go really wrong and your allowance gets slapped onto your second job, you're missing out on a whopping £4,500 of it! When this kind of thing happens, you need to get in touch with HMRC as quickly as possible. They've got a system for splitting your Personal Allowance between your jobs so that you don't end up paying too much tax overall.

It's worth pointing out that splitting your Personal Allowance might not be the best idea if the income from your PAYE jobs isn't predictable. If one of your gigs suddenly takes off and pays a lot more than expected, you might end up with the taxman sniffing around your circumstances because you've underpaid.

With your Personal Allowance attached to your “main” job, your other one will generally get a code that sees it taxed at the basic rate from the very first penny. That sounds a little painful, but it's pretty much the fairest way to handle it. Again, though, there can be some problems when the numbers flying around get bigger. If your combined income goes over the threshold for the higher rate of Income Tax (£50,271 for 2022/23), then your tax codes won't be right.

Let's say you've got a main job paying £35,000 a year and another one paying £20,000. Not too shabby overall, you think. However, if you don't square things with HMRC you might be looking at some trouble when they catch up to you. In total, you're making enough for some of your income to be taxed at the higher rate. Despite that, since your earnings for each job are below that threshold individually, you're only being taxed at the basic rate on each (after your Personal Allowance, of course). Again, you have to talk to HMRC to get this sorted out and prevent some tense situations with the taxman.