Wholesale, property, logistics and hospitality revealed as the worst for tax evasion

Tuesday 24th January 2023

Tuesday 24th January 2023

We can reveal that wholesalers, construction companies, logistics, hospitality and property professionals rank amongst the worst offenders when it comes to those penalised by HMRC for tax evasion.

We analysed data on individual penalties issued by HMRC since the start of the 2010 financial year for deliberately defaulting on tax, grouping these individual penalties by business trade or occupation to find which have been the worst offenders.

The research shows that since April 2010, an estimated £50.2m has been handed out in penalties, with the average penalty sitting at just shy of £31,000.

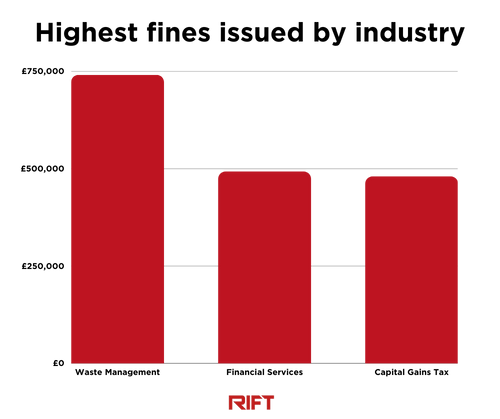

In terms of the average fine issued, those working in waste management have been hit the hardest at £739,931. The average fine issued within financial services sits at £491,831, while penalties issued for those deliberately trying to manipulate tax paid on capital gains ranked third (£479,251).

The adult industry (£258,105) and supply chain and wholesale (£202,760) also ranked within the top five for the highest average fines issued for deliberately defaulting on tax.

At an estimated £11.9m, it’s also the supply chain and wholesale trade that sits top of the table for the highest total of fines issued for defaulting on tax.

Building and construction ranks second with total fines issued sitting at £8.7m, with those working within logistics and transportation seeing the third highest level of total fines issued at £4.7m.

The hospitality industry has seen a total of £4.5m issued, while the wider property industry joins building and construction in completing the top five worst offenders, with £3.3m in fines issued to date.

CEO of RIFT Tax Refunds, Bradley Post, Commented:

Whether it be for attempts at tax evasion or tax avoidance, those operating outside of the boundaries of legality are likely to feel the wrath of HMRC at one point or another. While the former is a direct and illegal attempt to reduce tax owed and can even carry a prison sentence, the latter is considered as operating within the rules albeit on an ethically questionable basis.

However, dealing with HMRC can be a complex matter and all too often those trying to exploit legal loopholes by avoiding tax rather than evading it will also find themselves in hot water if they aren’t completely watertight when acting creatively with their tax returns.

While those deliberately defaulting on their tax affairs are far more prevalent within certain business trades or occupations, it’s certainly not a practice restricted to a handful of industries, albeit some may present a better chance to attempt it.

Despite HMRC seeing a -6.7% annual reduction, the gap between tax owed and tax paid still currently sits at £32.1bn and this gap is expected to widen as the nation struggles to combat the cost of living crisis.

Of course you do! Get a grip on your cash with our free money saving tips, guides and videos sent straight to your inbox. What have you got to lose?

RIFTPROD2 - Subscriber