Brexit Scams

We’re all still pretty worked up about Brexit, whichever side of the argument you took. The thing is, panic and chaos are exactly the kind of pressures the scammers thrive on. No one makes good decisions when they’re under stress, so we’re seeing a lot of fraudsters taking the taxman’s name in vain to try and grab your details. People are being told they need to register for a “UK trader number”, for example. As always, all they need you to do is supply a few key details to make the whole problem go away. Of course, by “problem” they generally mean “your cash”.

We’re also finding scammers offering “incredible investment opportunities” arising from Brexit, either to reduce its impact or seize on its supposed windfalls. You might even be told you’re due for a “Brexit severance” payment or something equally magical. Needless to say, you’ll never see a penny of that.

Dangerous Attachments

One of the key ways that scammers will try to get you is with an email attachment. It might be masquerading as an important tax document, or almost anything. The catch is that, if you open it, it dumps a virus or other malware into your system that could do anything from stealing your passwords to killing your computer altogether. One particularly ugly example is the ransomware attack. Basically, when the program runs it locks and encrypts a lot of your files so you can’t open them. The scammer then demands a hard-to-trace payment to unlock everything, usually via something like Bitcoin.

Social Media Scams

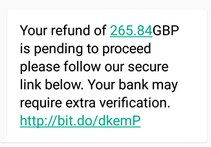

This is another pretty popular attack for tax scammers. It starts with a private message on a service like Twitter or Facebook. Suddenly, you find “HMRC” demanding payments or promising instant refunds. Again, the real HMRC won’t ever approach you like this. Don’t reply and never click the links they provide.

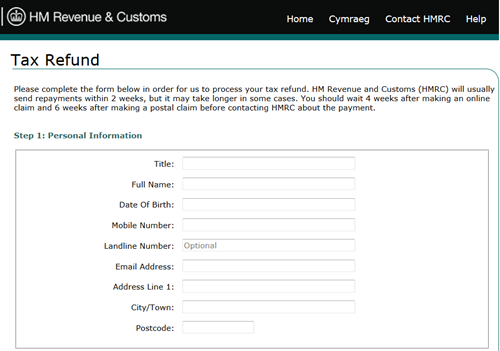

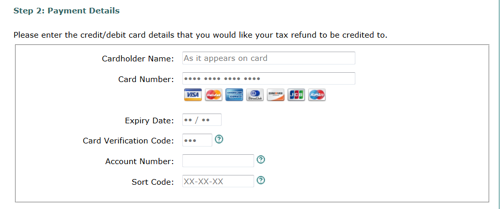

Tax Credit Scam

A particularly juicy target for the scam merchants seems to be people renewing their tax credits. That’s when they’re most likely to fall for fake calls or messages from HMRC. You might be told you’re owed a fat tax refund, or that you need to pay back some cash. Either way, all the scammers want is your personal and banking information. They might even try to trick you into making a payment directly to them.

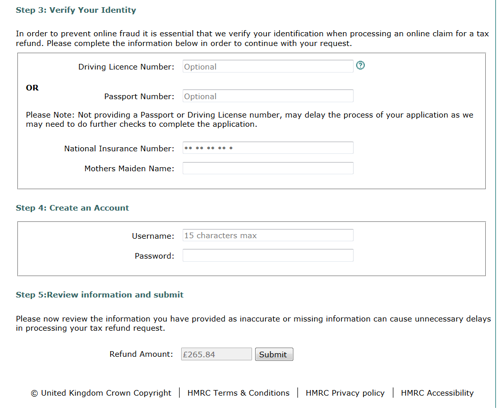

Here’s how to protect yourself:

- Never give out personal or banking details via text message or email. They’re so easy to fake, and HMRC will never ask you to do this.

- Don’t click any links or open any attachments you get in an unexpected message claiming to be from HMRC.

- Don’t get rushed into making bad decisions over the phone. HMRC won’t try to pressure or panic you in a phone call.

- Always report any dodgy calls or messages you get to HMRC. It’s definitely better to be safe than sorry.

- Call your bank if you’ve already fallen for a scam. They can often help. You can also get in touch with Action Fraud.

The Weird Stuff

There are even reports of scams where the fraudsters pretend to be HMRC, demanding a large tax payment in the form of iTunes vouchers. To most people, this probably sounds like a joke, but a surprising number of people are being taken in by it, losing an average of £1,150 each. These scammers tend to attack elderly people, thinking that they’re less likely to realise they’re being conned.