Money saving tips for holidays

Friday 19th May 2022

What's it all about?

This guide is designed to help you understand:

- How to save for that big holiday

- How to keep your travel expenses to a minimum

- How to spend efficiently when you get there

Friday 19th May 2022

What's it all about?

This guide is designed to help you understand:

Whether you’re jetting off on a European city break or road tripping along the south coast to the English Riviera, they can work out pretty pricey if you don’t have a plan. And if you’re not keeping track of your expenses as you go, you can be in for a nasty shock when your bank statement arrives upon your return home. Luckily, there are several things you can do while you’re away, and even long before you head off on your trip, to make sure you have a great time without emptying your bank account.

Too long to read? Watch it here.

We release a new video on YouTube every week. Be sure to subscribe to our channel so you don't miss out.

The best place to start is with a budget. After all, if you don’t know how much something costs on average, the chances are you’ll end up spending a lot more than necessary. Of course, one of the biggest factors in the cost of your holiday really is where you go. But once you’ve picked your destination, have a look online or in travel agencies to see how much travel and accommodation should cost. And if it’s any cheaper to bundle them together.

Then, think about how much you’ll spend each day you’re away, including tickets for any excursions, and add that to the price of accommodation and getting there. That should give you a pretty clear idea about what to budget for your trip.

However much you think the holiday should cost, put aside a bit more. While it’s tricky to anticipate things like car breakdowns and plumber callouts, these are the kind of expenses that could derail your holiday fund. If you expect the unexpected, you’ll be able to solve that short-term emergency and still get that relaxing break.

Even if you haven't decided where you’re going, having any kind of saving plan in place puts you in a great position when you finally pick your destination.

If you’re unsure where to start, how about saving £3 a day? By putting aside just £3 each day, you’ll have £1,100 in a year’s time. That’s enough to get you to the other side of the world, and all for the price of a daily cup of coffee.

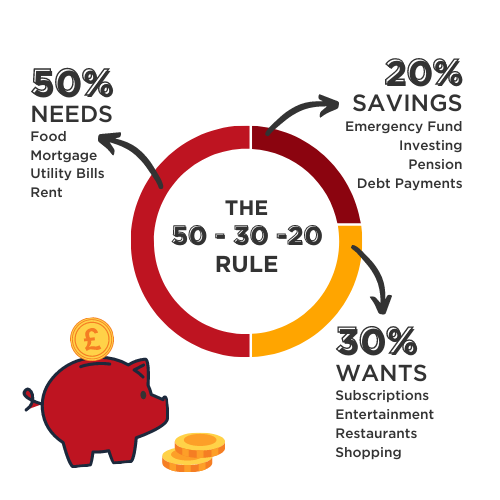

Our free 50/30/20 spreadsheet automatically divides up your income into three main categories:

If you’re anything like us, you’ll have multiple streaming services that you pay for, whether it’s for music, films, TV or books. Each of them are pretty good value for money, but altogether, if you’re paying for a few at a time, It can work out quite costly. If you’ve forgotten about one of the services you pay for, or you’ve simply stopped using it, just cancel it! Most run on a rolling monthly basis at £10 a month, so put that tenner straight into your holiday fund instead. £120 after a year could get you a seat on a return flight to Europe. There are ways to save as you spend, too. As of January 2022, 27% of British adults have opened an account with a digital-only bank. Soon, 93% of us will be banking online somehow, whether on apps or at our desktops. With your average bank account nowadays, the interest rates are pretty low, but apps have made it easier than ever to control our money and save towards a target. Banking apps like Monzo, Revolut and even NatWest all have a saving pot feature. You can set up a savings pot for that Summer holiday, and whenever you make routine purchases, it’ll round up to the nearest pound and put the spare change in your holiday fund. If it’s a big trip you’re planning for, you’ll need to save for it longer than you would for a weekend in Paris, for example. If you can wait a year for that holiday of a lifetime, why not put the money you save up into an ISA? ISA stands for individual savings accounts, and they’re tax free up to a certain amount. That means you don’t pay tax on the interest your savings gain. You’ll need to have your money in an ISA account for a year to earn the interest, and of course, some have better interest rates than others. Check out our video below to learn more about the different kinds of ISA that are available.

Sign up to receive email updates on our latest money saving tips, guides, competitions and more.

In this video we'll help you:

In most cases, wherever you go, the cost of getting there can vary massively and it pays to book early. That same seat can treble in price by the time your holiday rolls around, so get things off to a flying start by booking as soon as possible.

Before you start booking, remember to clear your cookies, and deny any unnecessary cookie permissions on any sites you visit. Many online booking websites use a dynamic pricing system that tracks the price you’ve been given for flights and package deals. Then, the price increases when you search repeatedly.

If you think you’ll forget to deny those permissions on each website visit, use an alternative browser that opts out of cookies, like DuckDuckGo.

Another great way to save on the cost of getting there is with reward schemes. For instance, Tesco Clubcard points can be exchanged for Virgin Atlantic points. These can be used to pay for flights to certain destinations. Think about that – your weekly food shop could pay for your airline seat!

If you’re not signed up to any reward schemes, don’t worry – there are still plenty of things you can do to make that ticket a bit cheaper.

Don’t just settle for the first price you see for a return flight. Price comparison sites like Skyscanner and Kayak not only compare the price of flights on the same day, but can also show you which day is the cheapest to fly in a certain month. So, if you’re flexible, keep in mind you can save a bundle by travelling on a certain day.

Once you’ve picked the days you’ll be away, take a look at the different times that are available. Night flights may be a pain, and you may have to go nocturnal for a couple of days, but they can be around 30% cheaper than afternoon flights. And much cheaper than flying out in the morning.

Finally, look out for the hidden charges before you book your seat. What does your ticket actually include? Many budget airlines offer very tempting flight prices, but once you get to the till, you find that some things are missing. Like your cabin bag, suitcase, and the chance to sit next to your partner or travel companion.

Paying for each of these things can take the total to more than you would’ve paid for other airlines that include them in their fares.

Whether you want to visit museums, go on a city tour, or any other excursion. These activities are nearly always cheaper when booked online and in advance than they are on the day at the box office.

Instead of getting stung by door prices when you get there, plan your days in advance and book your tickets before you arrive. Even if you only save a euro or two, that’s money you can put on your restaurant bill that evening. Make your cash go further!

Some of the banking apps that we mentioned previously, have a savings pot feature allow you to temporarily change your payment settings, so every time you pay by card, it comes straight out of the holiday pot instead of your normal account. That means that you’re only spending the money you’ve budgeted, and the money in your normal account stays untouched.

If you are planning on using a card instead of cash while you’re away, make sure you know about any fees you might incur before you go. Some banks will limit the amount of money you can withdraw without charge when you’re abroad, while some charge a fee for every transaction you make.

Look out for cards that don’t charge any fees for transactions, and also cards that go by the MasterCard or Visa exchange rate. Visa tend to offer a better exchange rate than MasterCard, but both are usually better than you’ll find at a bureau de change on the day.

That being said, if you’re planning to take local currency with you in cash, keep an eye out for the exchange rate before you go. You can find the best deal for exchanging currency on price comparison websites, so take a look before you get your money sorted!

It’s tough to sock away any spare cash when the cost of living’s high and lot of people are losing hope...

RIFTPROD2 - Subscriber