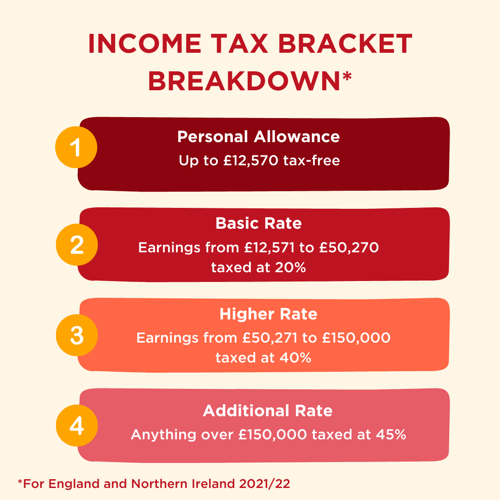

Even though the table contains the tax rates for each income, it leaves out two crucial points for those earning over £100k in a year. For every £1 that you earn above this amount, your personal allowance will reduce by £2 until it’s gone. Once you hit the £125,140 mark your allowance will automatically be set to £0 meaning that you’ll have to pay tax on everything you earn.

In real terms, anyone caught between £100k and £120k can actually be paying a whopping 60% in tax. You may earn £100k a year but with a bonus of £1,000 your total income is taken to £101k. That additional £1,000 will not only be taxed at 40% but will also knock £500 off your tax free personal allowance. This removal of £500 from tax will be charged at another 40%, leaving you with a meagre £400 from your £1000 bonus.

As you can see, even if you think you’ve got breathing space before hitting this threshold, it’s best to check if you’re inline for any big bonuses or commission before the end of the tax year. Many people don’t notice until they receive their tax slip and it’s too late to act.