Easy Ways to Save for a House on a Low Income

Reviewed by Head of Finance, Jason Scrivens-Waghorn (FCCA)

Reviewed by Jason Scrivens-Waghorn (FCCA) Jason Scrivens-Waghorn (FCCA) LinkedIn

Jason is the Head of Finance at RIFT, where he's been steering the financial ship for over 11 years. His role is all about ensuring smooth operations, from making sure customers are paid quickly an...

Read More about Jason Scrivens-Waghorn (FCCA)What's it all about?

This article's designed to help you:

- Get together what you need to buy a house

- Develop great saving habits

- Get the very most from your money

What deposit will I need?

When you make the decision to buy a house, you’re taking on what’ll probably be the largest debt you’ll ever have. Yes, that sounds scary, and it’s something you have to take seriously. However, typical mortgage interest rates aren’t nearly as high as you’d find on “smaller” debts like credit card balances. Plus, you’re making an important investment that can help steer your finances in the right direction for decades to come.

Location is everything when you start your house hunting expedition. Property prices can be wildly different around the UK, so you’ve got to weigh the asking prices against other factors, like where you work. On average, though, the typical first-time house buyer is probably looking at around £212,000.

So this is where you’ll usually encounter your first – and potentially largest – hurdle: the deposit. Depending on your situation, you could typically be asked to pay anywhere between 5% and 20% as a deposit. The exact figure will vary with the kind of property you’re buying and where it’s located. In general, though, the more you’re paying up-front, the better the deal you’ll tend to get on the actual mortgage. If you’re working somewhere with higher average property prices, like a major city, you might want to consider looking for a home a little further out and commuting in. The asking prices tend to drop the further out you look. Of course, you’re balancing that against your additional travel costs, so you’ve got some careful calculations to make either way. It might turn out that you’re actually better off toughing out the higher deposit now and taking the longer-term savings (and convenience) of not commuting.

So, let’s assume you’ve picked a place to buy and scouted out the kind of deposit it’ll take. Let’s look at some ways to help bring that number down.

Ways to reduce your deposit

In England and Wales, you might be able to take advantage of the Equity Loan system. You’ll have a few hoops to jump through and qualifications to hit, but it could be a big help. First off, you need to be a first-time buyer, with the place you’re buying being the only property you own and live in. To get the loan you’ll also need to pay at least a 5% deposit, plus the property has to be a new build from a homebuilder registered with the government’s Help to Buy scheme. On top of all that, you’ll need to arrange a repayment mortgage for a minimum of 25% of asking price. The maximum price of the property you’re buying through the Equity Loan system depends on where you’re looking. You can get the full details on the Gov.uk website. The loan can cover up to 40% of the asking price if it’s in London, or from 5% to 20% otherwise.

Obviously, this is a potentially great deal for first-timers looking to get a foot on the property ladder. It more or less eliminates your deposit worries, and you won’t pay interest on the loan in the first 5 years. After that, though, the interest does start to kick in, with the rate rising yearly by 1% more than the rate of inflation. Depending on how high inflation goes, you could find yourself paying a lot more than you expected overall, for instance, and rising interest rates could even end up costing you more than you can safely afford.

Meanwhile, changes in the actual value of the property can shift your position quite a lot. If it goes up, for instance, you’ll find yourself repaying more than the loan you initially took out. If it goes down, you could find yourself with “negative equity”, where the value of the property is actually lower than the amount you have left to pay off on the mortgage.

Another option to look at is the shared ownership system. Basically, if you can’t afford the pay a deposit up-front and mortgage payments later, you can arrange to buy a share of the property instead of the whole thing. You can buy between 10% and 75% of the property, based on its market value, and pay rent to a landlord on the rest of it. There’ll usually be a monthly ground rent charge, and service charges to go toward the property’s upkeep. You can get a mortgage for this if you don’t have the money to buy your share outright. The good thing about this is that it can bring your deposit way down, since it’ll only be based on the percentage of the property you’re actually buying. Deposits of 5%-10% of your share are fairly typical. Once you’ve got a shared ownership deal set up, you can actually start increasing your stake in the property by “staircasing”. This basically just means gradually buying more of the property until the whole thing’s yours.

Shared ownership deals can be a great way to minimise start-up costs for first-time homebuyers. You’ve still got to make sure you can keep up with the rent and mortgage payments, though. Since you’ll still count as a tenant in the property, missing rent payments can still cause problems up to and including actual eviction. The same goes for things like complaints from neighbours or breaking any rules and conditions. Also, since shared ownership deals are usually leaseholds, it can be tricky to sell up if you’re on a short lease.

How much can I borrow?

This is a big question, and it’ll shape basically every decision you make when you’re buying your home. Generally speaking, you can expect a bank to set a cap of 4.5 times your yearly salary. If you’re combining 2 people’s incomes for your calculations, you might find they set it at 3.5 times that combined figure.

So, for a mortgage based on a single salary, you're probably looking at a maximum of:

- Single salary of £20,000 per year: £90,000 mortgage

- Single salary of £30,000 per year: £135,000 mortgage

If you're a couple using both incomes for the deal, those maximum figures would be:

- Combined income of £20,000 per year: £70,000 mortgage

- Combine income of £30,000 per year: £105,000 mortgage

How to save

Once you know what to expect from your mortgage offer, and what the property you’re buying will cost overall, you can start planning how to save up the rest. Having that specific target in mind will give you a good idea of how long it’ll take to save what you need.

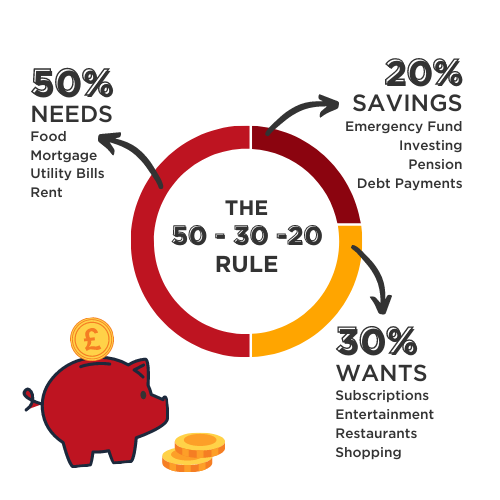

If you’ve read any of our other articles on winning strategies for savers, then you’ve probably already heard us talk about zero-based budgeting and the 50/30/20 rule. You can get the full details by checking out 4 Fixed Income Saving Strategies – Combine to Win! But here are the basics in brief:

- Zero-based (or zero-sum) budgets mean working out where every penny of your income’s coming from, and where every penny of it’s being spent, saved or invested.

- The 50/30/20 rule is a way of dividing your income into needs, wants and savings. 50% goes on essentials, 30% can be blown on “fun stuff” and the remaining 20% is saved.

Another essential saving tip is to pay down your debts as soon as you can. In the long run, interest on money you owe will almost always stack up faster than on money you save. Over time, your debts get heavier, and can easily end up outweighing the benefits of saving.

With saving, little and often is usually a stronger strategy than occasionally dumping in larger amounts. See our 12 Everyday Money Saving Hacks article for some tips on how to develop good saving habits. It all mounts up with time.

You should also consider whether you could cut the costs of any rental deal you’re on. Rent can eat a huge chunk out of your monthly earnings, and can be very painful when you’re trying to save for a house. If you’re living on your own, for instance, you might try looking into a flat-share arrangement instead. If you don’t already know anyone you could team up with, there are flat-sharing websites that can help you out. A variation on this is co-living, where you share things like kitchens and shared spaces in a purpose-built property but still rent your own room.

The main thing is to keep your expectations realistic and be patient - and remember to celebrate your saving successes! When you’re on a lower income, any saving you do is a definite win. Keep checking back here for more money tips and updates. We’re experts at saving you cash and we’re always here to help. That’s the reason why you’re better off with RIFT.

RIFT Roundup: what it all means

- Negative equity: When the amount left to pay on a property is more than its total value.

- The 50/30/20 rule: A simple way to divide up your money so you don't lose control of it.

- Leasehold: An agreement with a landlord to own a property for a limited time, usually years.

Free tax refund checker: Our tax rebate calculator will give you an instant estimate of how much tax you could be owed back from HMRC

Start Now